Mortality is a topic that gets a lot of coverage when it has to do with humans, may be not enough when it comes to businesses, especially successful and large businesses. When I think about them, I am reminded of the quote “The idea is to die young as late as possible” – By Ashley Montagu – A British-American anthropologist.

The fountain of youth is germane to the characteristics of a startup as well as the ones that have transformed to address the digital revolution. Successful companies in the age of digital revolution have to be nimble while operating at a scale.

The failure rate of start-ups and the inability of the large companies to adapt and survive is well documented. The traditional business models have typically forced the thinking to an either-or scenario between start-up and scale companies. A quick look at the list of fortune companies over the last 15 years will give you an idea of how difficult these companies find to adapt.

Companies that can achieve both are going to become dominant players and can delay the inevitable mortality. Few companies from both ends of the spectrum have made it and created a model to thrive in this age. The questions, Why, and can you do something about it, are of interest to me.

A look back at last decade (2008 – 2017)

Here is a quick review on the performance of large companies in Dow Jones and Unicorns.

- Stock markets have done extremely well, for instance Dow has created $3.7 Trillion in wealth, with returns at rate of 114%.

- A review of 168 exits by Unicorns since 2009 listed on CBINSIGHTS, have created about $719 Billion, with returns at rate of 992% for the venture capitalists and the founders.

- A list of Unicorn companies on the same website, that have not exited have been valued at $815 Billion approximately with 80% of the valuation coming from companies that were started 2013 or later.

A closer look at the Unicorns and the Companies on Dow Jones index highlights the disparity in success. This could be an indicator of longevity of the companies on the Dow Jones. The Unicorn companies on the other hand are akin to digital natives and have been able to create value at an order of magnitude higher than the companies in Dow Jones Index.

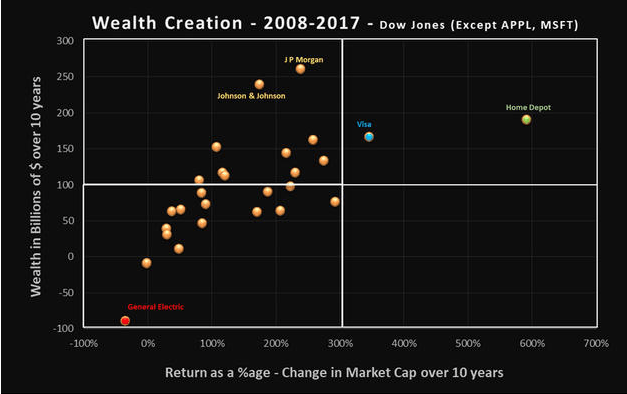

Let us look at the illustration below that has the value and rate of return for all the Dow Jones companies excluding Apple and Microsoft. Looking at the range of returns from negative 100% to 700% on X-Axis, and negative $100 to $300 Billion dollars on Y-Axis, you can see only two companies have a 300% plus return with at least $100 Billion in value over the 10 years, Home Depot and Visa.

J.P.Morgan and Johnson & Johnson have performed relatively well with higher value creation, though the rate of return over a 10 year period is in the normal range. I also would never have predicted General Electric to be the worst performing during this time.

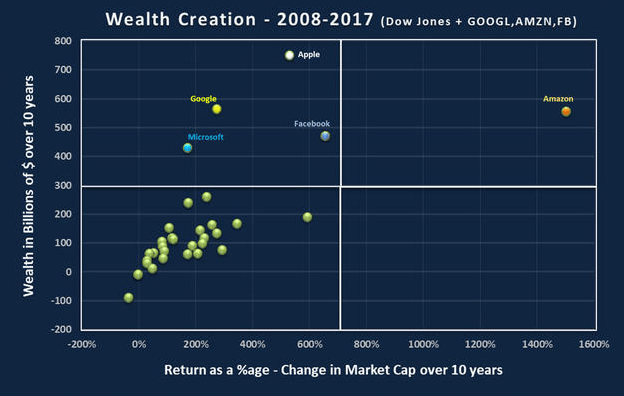

Now let us look at the second illustration with all Dow Jones companies including Apple and Microsoft, along with Google, Facebook and Amazon.

-

“One thing I love about customers is that they are divinely discontent“, quotes Bezos in his most recent letter to the shareholders. For the CEO of a company that is ranked 1st in American Customer satisfaction index 8th year in a row to say this, is indicative of how obsessed they are about customers.

-

In today’s landscape, Customers are being empowered with better information and easier way of doing things constantly and the expectations constantly evolve.

-

“We want to be a large company that’s also an invention machine“, from Bezos’s letter in 2015. He talks about the traps/pitfalls for large organization that hurts speed and inventiveness.

-

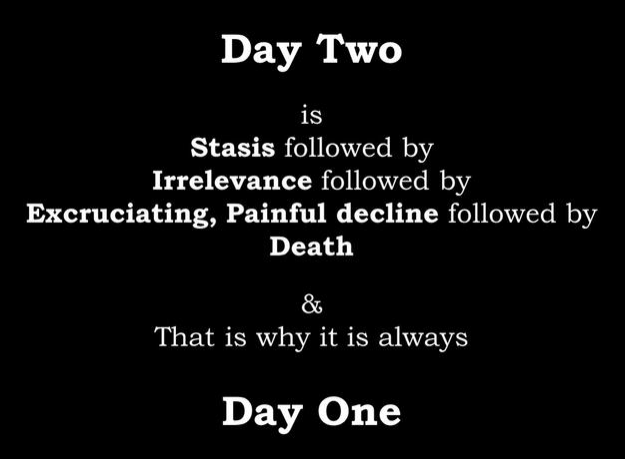

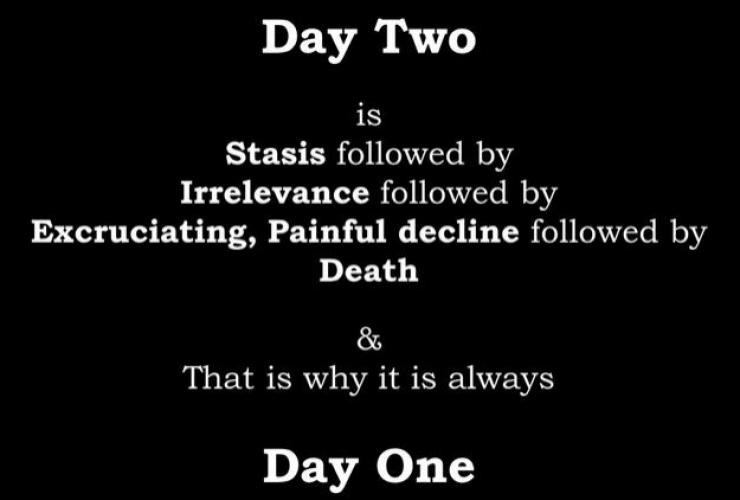

That trap according to him is “One-size-fits-all” decision making. Larger organizations typically focus on just the quality of decision making and give no credence to the velocity of decision making, resulting in slowness, unthoughtful risk aversion, failure to experiment sufficiently and consequently diminished invention.

-

If you are good with course correcting, being wrong may be less costly than you think, whereas being slow is going to be expensive for sure.

-

“Most large organizations embrace the idea of invention, but are not willing to suffer the string of failed experiments to get there” A culture of experimenting with new ideas is necessary for invention, which means to risk failures.

-

The long-tailed distribution of returns require the big bold winners pay for a lot of experiments. Outsized returns are typically a result of betting against the conventional wisdom. Amazon has been successful with Marketplace, Prime and AWS by taking such bold bets.

-

These successes have not come without big failures, the largest and most notable being Amazon Fire Phone. Bezos also goes on to proudly say that he has made billions of dollars of failure.

-

Bezos in his 1997 letter, the first to shareholders had a section, it’s all about the long term. In this section, he writes “Because of our emphasis on the long term, we may make decisions and weigh trade-offs differently than some companies”

-

A few underlying principles:

-

They make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street considerations.

-

When forced to choose between the appearance of GAAP accounting and present value of future cash flows, pick the latter.

-

Choose to prioritize growth because we believe scale is central to achieving the potential of business model

-

Just compare Amazon’s cumulative profits since the beginning to Walmart’s profit over the last couple of years, and it is hard to believe that Amazon’s market capitalization is over twice that of Walmart’s at the end of 2017.

-

“No matter how good an entrepreneur you are, you’re not going to build an all composite 787 in your garage startup, not one you’d want to fly in any way” Bezos understands that in order to build and scale the bets that work requires operational excellence and attributes his success of the three major pillars to it.

-

The bold bets that turned into the key pillars and requiring Amazon to operate at a scale are AWS with $20 billion in revenues, Prime with 100+ Million members, and Marketplace with more than 50% of items sold on the platform are by third-party sellers

-

Amazon has strived to achieve operational excellence through high standards deployed widely and at all level of details. Creating environments to nurture high standards will help you build better products and services, recruit and retain resources, and doing exceptional on the work that is invisible. Bezos goes on to say, High standards are contagious and so too are low standards.

No comment yet, add your voice below!